Great Keppel Ltd provides defined superannuation benefits to two (2) of its employees which represents an entitlement of three times their final salary on retirement. The company's superannuation plan is managed by Better Super Funds.

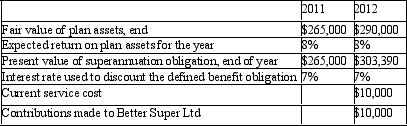

The following details are relevant to the superannuation obligation of the company for the years ended 30 June 2011 and 2012:

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 "Employee Benefits" in preparation of the financial statements for the year ending 30 June 2012?

A) No action necessary as the contribution of $10,000 was remitted to better Super Ltd.

B) No action necessary as the assets and liabilities of the superannuation for its employees are managed by Better Super Ltd.

C) Recognise a superannuation obligation of $13,390 being the difference between ending balance of plan assets and the present value of superannuation obligation as at 30 June 2012.

D) Recognise a superannuation expense of $38,390 for the year 2012 being the difference between beginning and ending balance of the present value of superannuation obligation.

E) None of the given answers.

Correct Answer:

Verified

Q44: AASB 119 divides employee benefits into a

Q50: A non-contributory superannuation fund means:

A) No contributions

Q53: Junior Ltd employs three workers to develop

Q56: Junior Ltd employs three workers to develop

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents