Gerbert Ltd enters into a finance lease with Hokiman Ltd on 1 July 2002 for an item of machinery that has a fair value at that date of $226,718. The lease is for a period of 4 years, with annual lease payments of $62,000 due on 30 June each year, the first payment to be made in 2003. There is a bargain purchase option of $15,000 available for Hokiman to exercise at the end of the lease period. The rate of interest implicit in the lease is 6 per cent. It cost Gerbert Ltd $190,000 to manufacture the machine. What are the entries in the books of Gerbert Ltd for 1 July 2002 and 30 June 2003 (round amounts to the nearest dollar) ?

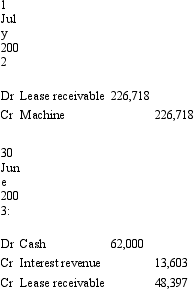

A)

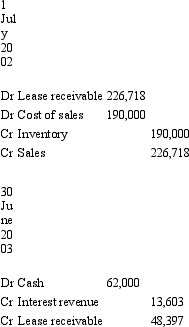

B)

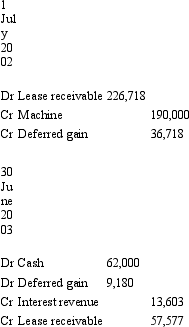

C)

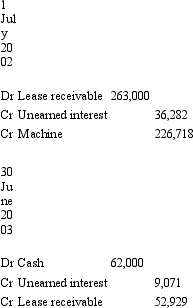

D)

E) None of the given answers.

Correct Answer:

Verified

Q25: AASB 117 defines the benefits of ownership

Q39: Joplin Ltd entered into a lease agreement

Q40: Quaid Ltd entered into a lease agreement

Q41: The rental payments made during the term

Q42: Schwann Ltd enters into a non-cancellable 5-year

Q46: A non-cancellable lease is a lease that

Q54: The amount of a lease receivable recorded

Q56: Where a lessor is involved in a

Q68: For a depreciable asset,the amount of depreciation

Q69: From the perspective of the lessor,finance leases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents