Schwann Ltd enters into a non-cancellable 5-year lease for office space in Bigtown's central business district. The building has an expected remaining life of 40 years. Schwann Ltd has been offered a free fit-out of the office as an incentive to take up the lease. The fit-out would have cost Schwann Ltd $90,000 to do itself. The benefits of the fit-out are to be recognised on a straight-line basis. The rental payments are $110,000 per annum. How would the signing of the lease and the first rental payment be recorded by Schwann Ltd in accordance with UIG Abstract 3?

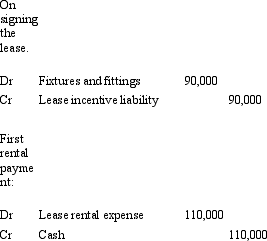

A)

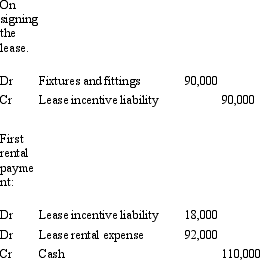

B)

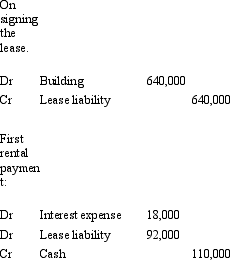

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q25: AASB 117 defines the benefits of ownership

Q39: Joplin Ltd entered into a lease agreement

Q40: Quaid Ltd entered into a lease agreement

Q41: Gerbert Ltd enters into a finance lease

Q41: The rental payments made during the term

Q46: A non-cancellable lease is a lease that

Q47: Medusa Ltd enters into a non-cancellable 10-year

Q54: The amount of a lease receivable recorded

Q68: For a depreciable asset,the amount of depreciation

Q69: From the perspective of the lessor,finance leases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents