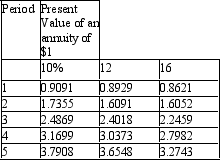

Kingslake Ltd signed a non-cancellable lease contract on 1 January 2012 for a machine that requires 5 annual payments of $200 000 at the start of each year. On the last annual payment, ownership will transfer from the lessor to Kingslake Ltd. The fair value of the asset if paid in cash is $75,964.

The following information is also available:

What is the implicit rate of this lease arrangement in accordance with AASB 117?

A) 10%

B) 12%

C) 16%

D) Between 10% and 12%

E) Between 12% and 16%

Correct Answer:

Verified

Q1: In a lease arrangement that is classified

Q4: At inception of the lease,what is the

Q15: Snowy River Ltd is a lessee to

Q48: A finance lease in which the lessor

Q51: From the point of view of the

Q53: Where there is a lease involving a

Q61: Alpine Ltd signed a 10-year non-cancellable lease

Q64: On 1 January 2012 Dobel Ltd signed

Q66: For a lessee entering into a finance

Q72: What characteristic(s)of land means that the lessee

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents