Nerang Orange Farms Ltd has orange tress which on 30 June 2009 had a fair value of $1,600,000. On 30 April 2010, oranges with an estimated market value of $300,000 were picked. The costs of picking, sorting and packing paid in cash amount to $150,000. The oranges were sold on the same day for $310,000. An independent valuation on 30 June 2006 report that the estimated fair value of the orange trees is $1,500,000. What is the journal entry to recognise the harvest of oranges on 30 April 2010?

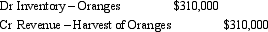

A)

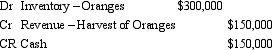

B)

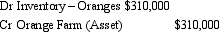

C)

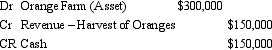

D)

E) None of the given answers.

Correct Answer:

Verified

Q41: One approach to revenue recognition proposed for

Q45: Which of the following are within the

Q47: Which of the following statements is a

Q48: Which of the following are considered agricultural

Q49: Which of the following statements is correct

Q49: Margaret Ltd has a vineyard and at

Q51: Which of the following items are not

Q53: What is the accounting treatment for a

Q56: Which of the following items are not

Q57: One approach to revenue recognition proposed for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents