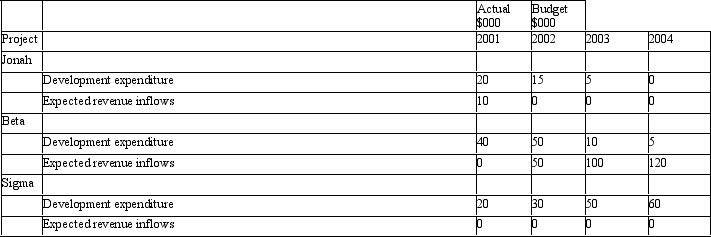

Castle Co Ltd is working on three research projects. Project Jonah is government-sponsored research on synthesising currently available research results on the possible triggers of asthma attacks. Project Beta involves researching the genetic tags associated with heart disease based on the genome project. A test to identify the predisposition to heart disease in children has been developed and will be on the market in 2003. Since 2001 research and development expenditures on this project are applied development costs only. Project Sigma is cutting edge research being conducted to try and discover a means of 'disassembling' molecules and then 'reassembling' them in their original form. The company hopes that this work will lay the basis for future dreams of teleportation as a method of transport. Details of expenditures and recoverable amounts expected beyond a reasonable doubt at this time are:

What is the total research and development deferral for each project as at the end of the year 2002?

A) Jonah: $15,000 Beta. $90,000 Sigma. $0

B) Jonah: $20,000 Beta. $50,000 Sigma. $30,000

C) Jonah: $15,000 Beta. $70,000 Sigma. $50,000

D) Jonah: $0 Beta. $90,000 Sigma. $0

E) None of the given answers.

Correct Answer:

Verified

Q1: Identifiable intangible assets are those intangible assets

Q8: Goodwill is a term used for the

Q12: Development costs are less likely to meet

Q17: Continuously Contemporary Accounting emphasises an entity's ability

Q21: There is a concern that research and

Q25: Purchased goodwill is recognised as the amount

Q30: What is the test for deferral of

Q31: In order to determine whether or not

Q37: The release of AASB 138 has had

Q39: Examples of elements of a business that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents