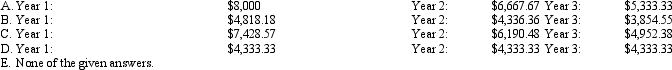

Hugo Ltd has acquired a machine for $26,000 and it cost a further $2,000 to install and set up the machine for operation. It is expected to operate within normal parameters for 6 years. It will be technologically obsolete in 10 years. The expected salvage values are $1,500 after 10 years and $2,000 after 6 years. The benefits to be derived from the machine are expected to be greater in the early years of its life. What depreciation should be charged in each of the first 2 years of the equipment's life using sum-of-digits depreciation?

Correct Answer:

Verified

Q21: French Co Ltd has a machine with

Q22: What issues need to be addressed to

Q27: Profit on the sale of an asset

Q29: The useful life of an asset may

Q30: Tantrax Ltd has just purchased a piece

Q32: AASB 116 requires that depreciation be reviewed

A)

Q33: Cutting Edge Ltd purchased a state of

Q35: Super Industries purchased a new vehicle on

Q38: Precious Gems Co purchased a diamond-cutting machine

Q38: Red Enterprises purchased a vehicle for $35

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents