Fast Movers Ltd purchased a machine on the first day of their financial year: 1 January 2002. The machine cost $75 000 and has an expected useful life of 10 years at which time its salvage value will be $8000. An even pattern of benefits is expected to be derived from the machine. Then on 31 December 2005 (3 years later) the machine is sold for $65 000. What are the appropriate journal entries to record the disposal of the machine in line with the requirements of AASB 116?

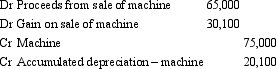

A)

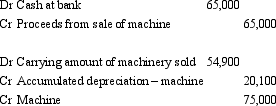

B)

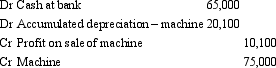

C)

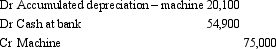

D)

E) None of the given answers.

Correct Answer:

Verified

Q2: Depreciation functions as an allocation process of

Q6: The expenditure to modify an asset so

Q9: Under the declining balance method of depreciation,the

Q15: Amortisation has the same meaning as depreciation,but

Q25: When selecting a method of cost apportionment

Q26: Forwind Ltd has recently acquired a machine

Q30: Assets should be depreciated from:

A) The date

Q37: Where an asset is revalued,the treatment of

Q39: Boysone Ltd has constructed a piece of

Q40: Magpie Ltd purchased a building on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents