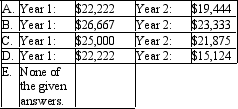

Kent Express owns a fleet of delivery vehicles. They were purchased for $120 000 and are expected to have a useful life of 8 years. Their residual value is expected to be $20 000. What is the depreciation expense recorded using the sum-of-digits depreciation method in years 1 and 2 (rounded to the nearest dollar)?

Correct Answer:

Verified

Q27: Profit on the sale of an asset

Q33: Cutting Edge Ltd purchased a state of

Q38: Red Enterprises purchased a vehicle for $35

Q41: In light of a company being subject

Q43: Priceless Products Ltd purchased some display stands

Q45: A non-current asset has the following information

Q48: The company recently acquired factory equipment. Which

Q54: AASB 116 requires disclosure of a reconciliation

Q57: Swans Ltd constructed a building on a

Q58: A company recently replaced a significant part

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents