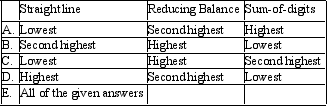

The company has a depreciable asset with a purchase price of $500,000 and an estimated residual of $20,000. The company estimates that the asset will generate future economic benefits for the next 10 years. You are not sure on what depreciation method to adopt but would like to be aware of the effect of using different depreciation methods. Which of the following is correct with respect depreciation expense for Year 1?

Correct Answer:

Verified

Q41: In light of a company being subject

Q43: Priceless Products Ltd purchased some display stands

Q45: A non-current asset has the following information

Q46: Intangible assets are not depreciated under AASB

Q48: The company recently acquired factory equipment. Which

Q49: Galway Ltd purchased a computer for $6,000

Q50: Pursuant to AASB 116,what is the carrying

Q51: Percy Ltd has a piece of equipment

Q54: AASB 116 requires disclosure of a reconciliation

Q55: Managers of some entities have resisted depreciating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents