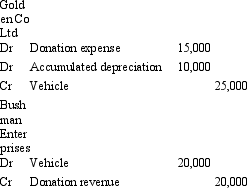

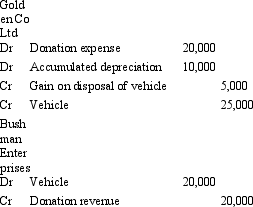

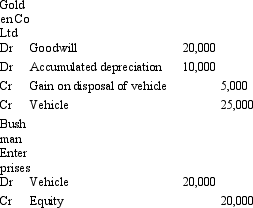

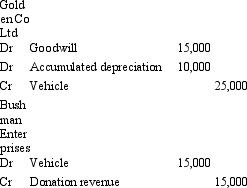

Golden Co Ltd has donated a vehicle to Bushman Enterprises as a result of publicity about the plight of Bushman Enterprises after bushfires destroyed most of its fleet of vehicles. The vehicle had cost Golden Co $25 000 and has accumulated depreciation of $10 000. Its market value is $20 000. How should the asset transfer be recorded in both companies' books?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q42: It is expected that the service potential

Q48: AASB 108 (Accounting Policies,Changes in Accounting Estimates

Q49: The effect of capitalising expenditures is to:

A)

Q50: If an impairment loss recognised in prior

Q52: Which of the following items are required

Q52: Calling Card Co Ltd has acquired a

Q56: The accountant in preparation for the financial

Q57: If the entity received a donated asset

Q58: An accountant is not sure on how

Q60: Recoverable amount of an asset is defined

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents