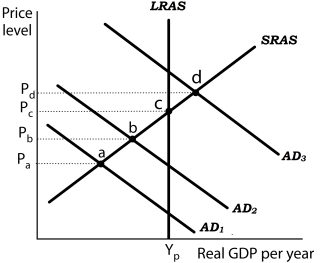

Figure 16-3

Panel (a) Panel (b)

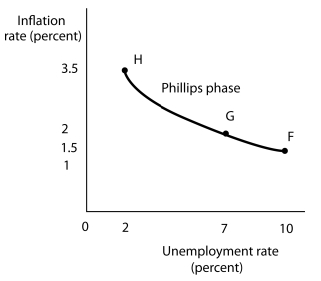

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

-Refer to Figure 16-3. The Phillips phase of the inflation-unemployment cycle is explained

A) by a stagnant short-run aggregate supply curve.

B) by leftward shifts of the aggregate demand curve in each successive period.

C) by upward shifts along the LRAS curve in each successive period.

D) by rightward shifts of the aggregate demand curve in each successive period.

Correct Answer:

Verified

Q22: Figure 16-2 Q22: In the late 1970s, the U.S. economy Q23: Figure 16-2 Q25: In the early 1970s, President Nixon inherited Q25: Stagflation implies that Q26: A period characterized by declining inflation and Q27: A period marked by rising unemployment and Q32: Rising inflation means Q34: During a recovery phase, Q38: Falling inflation means![]()

![]()

A) policymakers can choose to

A) that the price level

A) inflation and unemployment

A) that the price level

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents