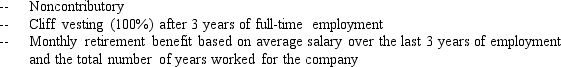

Melissa's retirement plan is described in her employee handbook as follows:  Which of the following statements about this retirement plan is(are) true?

Which of the following statements about this retirement plan is(are) true?

A) Melissa will have to contribute to the plan.

B) If Melissa leaves this company before working full-time for 3 years,she will not receive any benefits.

C) Melissa will have to make investment decisions regarding her retirement plan.

D) This is a defined contribution plan.

E) All of the above.

Correct Answer:

Verified

Q109: One can maximize the monthly Social Security

Q112: Dr.Johnson is surgeon at University Hospital.She will

Q118: Major sources of retirement income include all

Q119: Funds to finance social security come from

A)voluntary

Q120: Jamie has worked for ABC Printing for

Q124: Henry has a defined benefit plan that

Q126: Employer matching contributions are common with _

Q127: A _ plan combines some of the

Q132: The Employee Retirement Income Security Act (ERISA)provides

A)

Q133: Which of the following types of retirement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents