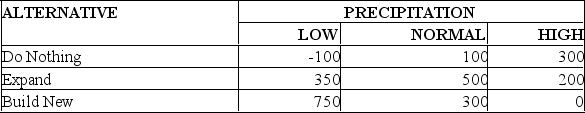

The operations manager for a well-drilling company must recommend whether to build a new facility,expand his existing one,or do nothing.He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:  If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

A) $140,000

B) $170,000

C) $285,000

D) $305,000

E) $475,000

Correct Answer:

Verified

Q23: The difference between expected payoff under certainty

Q24: The construction manager for Acme Construction,Inc.must decide

Q25: A former politician,who is now the owner

Q26: A sensitivity analysis graph:

A)provides the exact values

Q27: What is the method used for calculating

Q29: The operations manager for a well-drilling company

Q30: The owner of Tastee Cookies needs to

Q31: Decision maker's values,preferences and attitudes toward risk

Q32: A decision tree is:

A)an algebraic representation of

Q33: A tabular presentation that shows the outcome

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents