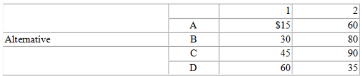

A manager has learned that annual profits from four alternatives being considered for solving a capacity problem are projected to be $15,000 for A, $30,000 for B, $45,000 for C, and $60,000 for D if state of nature 1 occurs; and $60,000 for A, $80,000 for B, $90,000 for C, and $35,000 for D if state of nature 2 occurs.

(i) If P(State of Nature 1) is .40, what alternative has the highest expected monetary value?

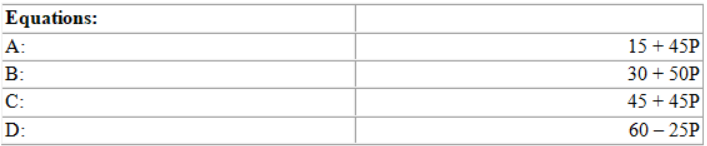

(ii) Determine the range of P(S2) for which each alternative would be optimal.

(i) Max EMV is C ($72)

(ii) Refer to the diagram, above.

Ranges:

D is optimal from 0 < .214

C is optimal from > .214 to 1.00

Correct Answer:

Verified

Q60: The advertising manager for Roadside Restaurants,Inc.needs to

Q61: Two professors at a nearby university want

Q62: Two professors at a nearby university want

Q63: A manager has developed a payoff table

Q64: A manager's staff has compiled the information

Q65: Two professors at a nearby university want

Q67: One local hospital has just enough space

Q68: A manager is quite concerned about the

Q69: Two professors at a nearby university want

Q70: Two professors at a nearby university want

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents