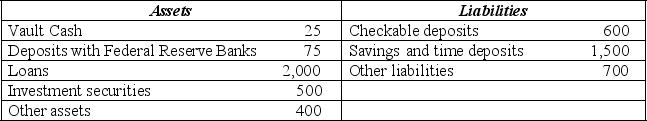

Table 9-3

Balance Sheet of the Alpha-Beta Bank

(All figures in $ million)

-Refer to Table 9-3. If the required reserve ratio is 10% and the market interest rate is 6%, then the opportunity cost of holding excess reserves is

A) zero since Alpha-Beta does not hold any excess reserves.

B) $0.9 million.

C) $2.4 million.

D) $4 million.

Correct Answer:

Verified

Q83: Table 9-3

Balance Sheet of the Alpha-Beta Bank

(All

Q85: Table 9-3

Balance Sheet of the Alpha-Beta Bank

(All

Q86: A bank that has no excess reserves

A)

Q89: Table 9-4

Acme Bank: Partial Balance Sheet

(All figures

Q90: A bank has $100,000 in checkable deposits

Q91: Table 9-3

Balance Sheet of the Alpha-Beta Bank

(All

Q92: Suppose the required reserve ratio is 10%.

Q95: A bank has $100,000 in checkable deposits

Q99: Any reserves that banks hold in excess

Q100: When banks hold more reserves than are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents