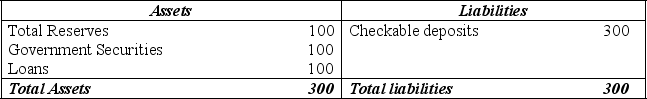

Table 9-5

Bolton Bank: Partial Balance Sheet

(All figures in $ million)

-Refer to Table 9-5. If the required reserve ratio is 10% and the market interest rate is 8%, what is Bolton Bank's opportunity cost of holding the excess reserves it is currently holding?

A) $5.6 million

B) $3.2 million

C) $0.8 million

D) 0; Bolton Bank has no excess reserves.

Correct Answer:

Verified

Q102: When a bank receives new deposits, it

Q106: Suppose the required reserve ratio is 10%.

Q107: Suppose the required reserve ratio is 10%.

Q110: Table 9-6: Deposit Expansion Stages

Q111: Table 9-6: Deposit Expansion Stages

Q113: Table 9-5

Bolton Bank: Partial Balance Sheet

(All figures

Q114: Table 9-6: Deposit Expansion Stages

Q117: Table 9-6: Deposit Expansion Stages

Q118: Table 9-5

Bolton Bank: Partial Balance Sheet

(All figures

Q119: Table 9-5

Bolton Bank: Partial Balance Sheet

(All figures

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents