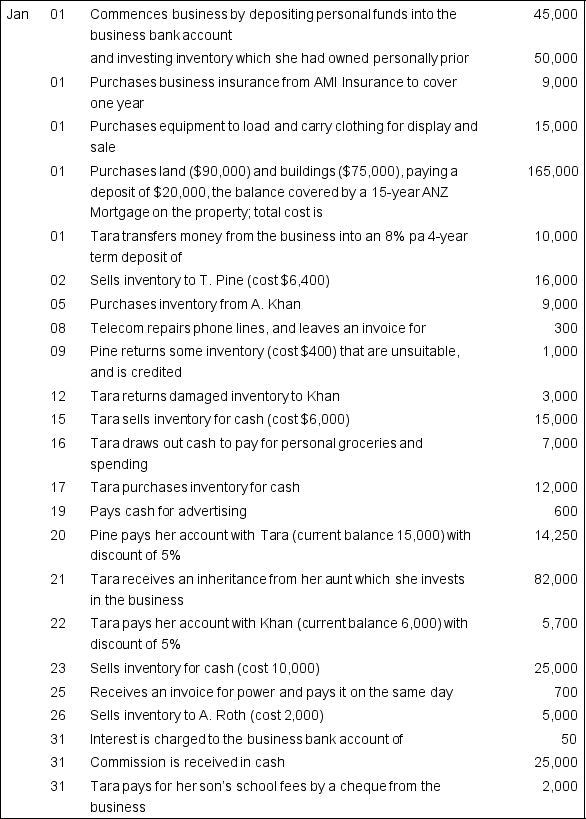

The following are the transactions for Tara's T-Shirts,a sole trader clothing retailer,for the month of January of the current year.Tara uses the perpetual inventory system.Ignore GST.All transactions are on credit unless otherwise stated.

Additional information:

Additional information:

• The ending stocktake (count)is $42,300.

• Rates are estimated to be $2,100 for the year.

• Commission is for work which is only 25% completed.

• A provision of 5% for doubtful debts is to be made.

• Depreciation on the buildings is to be at 3% per annum straight line (1 month).

• Depreciation on equipment is to be at 25% per annum diminishing value (1 month).

Using the data above,complete an accounting equation worksheet using the format given in Smart,Awan & Baxter,p.163.Show the final calculation of A = L + OE.

Principles of Accounting 5th Edition Chapter 6 Example examination questions

© Pearson 2014 PAGE 13

Correct Answer:

Verified

Q1: Other comprehensive income items:

A)are realised items that

Q3: Which of the following defines General and

Q4: Select the true statement:

A)Revenue expenditure is added

Q5: Distinguish between cash basis accounting and accrual

Q6: Explain why accrual accounting is the preferred

Q7: Explain the 3 aspects of the NZ

Q8: Which of the following defines Financial expenses?

A)Costs

Q9: Your friend Randolph has been reading about

Q10: The following information is available at balance

Q11: Craig Smith purchased a retail sports clothing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents