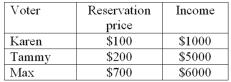

A public good that would benefit Karen,Tammy,and Max has a one-time installation cost of $900.These three voters must approve any tax plan by a simple majority and all three will cast a vote.

-Refer to the information above.Suppose that the government accurately knows the three reservation prices and the cost of the public good.To achieve the ideal tax structure and collect no more in tax revenue than $900,each voter should be charged __________ of their __________.

A) 100%;reservation price

B) 70%;reservation price

C) 20%;income

D) 90%;reservation price

E) 10%;income

Correct Answer:

Verified

Q33: A public good that would benefit Karen,Tammy,and

Q34: Empirical studies have found that the demand

Q35: A public good that would benefit Karen,Tammy,and

Q36: A public good that would benefit Karen,Tammy,and

Q37: A proportional tax results in

A) a larger

Q39: A public good that would benefit Karen,Tammy,and

Q40: A public good is a good

A) that

Q41: Allowing the government to assess and collect

Q42: Regressive tax rates mean that the ratio

Q43: If taxpayers pay a larger fraction of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents