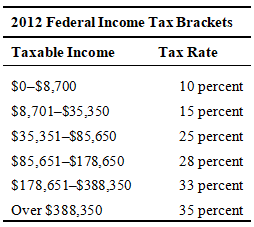

Refer to the following table to answer the following questions:

-Using the table,what is the total federal income tax bill for someone who makes $67,000 per year?

A) $16,750

B) $12,780

C) $11,169

D) $10,050

E) $6,700

Correct Answer:

Verified

Q43: Typically,the average tax rate for a person

Q44: The United States has a _ income

Q45: According to the U.S.Federal Tax Rates chart

Q46: Suppose you graduate with an accounting degree

Q47: The most relevant tax rate for making

Q49: Payroll taxes

A) are not paid by individuals

Q50: The current tax rate for Social Security

Q51: Suppose you are offered a job with

Q52: Some people argue that social insurance taxes

Q53: A progressive income tax system is one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents