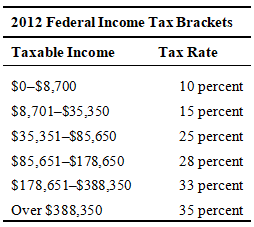

Refer to the following table to answer the following questions:

-Using the table,what is the marginal income tax rate for someone who makes $67,000 per year?

A) 10.0 percent

B) 14.2 percent

C) 16.7 percent

D) 25.0 percent

E) 19.1 percent

Correct Answer:

Verified

Q64: The top 1 percent of households in

Q65: Refer to the following table to answer

Q66: Why do wealthy citizens contribute much higher

Q67: The most recent federal budget surplus occurred

A)

Q68: What is the most appropriate way to

Q70: Refer to the following table to answer

Q71: A U.S.federal government budget surplus occurs when

A)

Q72: A U.S.federal government budget deficit occurs when

A)

Q73: The highest marginal tax rate in 1913

Q74: If government revenues in 2011 were $2.2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents