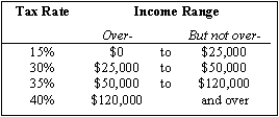

Exhibit 14-3

-Refer to Exhibit 14-3. Calculate the average tax rate of an individual whose taxable income is $65,000 and who has total deductions and exemptions of $10,000.

Correct Answer:

Verified

Tax on first = $25,000 = $25,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Exhibit 14-3 Q83: Exhibit 14-3 Q84: The U.S. social security retirement program is Q85: All transfer payments are means-tested. Q86: If a tax is imposed on a Q88: A more efficient tax system imposes smaller Q89: A government payment to an individual because Q90: Head Start is a program that gives Q91: Explain the difference between a marginal income Q92: With income below $10,000, the earned income![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents