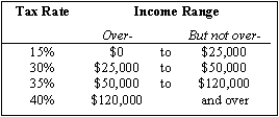

Exhibit 14-3

-Refer to Exhibit 14-3. Calculate the tax if an individual makes a total of $150,000 in income, has deductions of $8,000, and receives an exemption of $2,500 for each of five dependents.

Correct Answer:

Verified

Taxable income = $150,000 -$8,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: With income below $10,000, the earned income

Q93: Why is it irrelevant whether the employer

Q94: To keep deadweight losses to a minimum,

Q95: What is the difference between a proportional

Q96: A means-tested transfer program intended to help

Q98: Above _ in income, the earned income

Q99: Suppose that a four-person family can earn

Q100: The ability-to-pay principle is the idea that

Q101: In the United States, the top quintile

Q102: Give two examples of means-tested programs and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents