You Make the Call-Situation 2

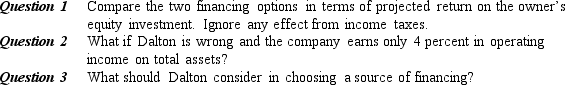

Carter Dalton is well on his way to starting a new venture-Max, Inc. He has projected a need for $350,000 in initial capital. He plans to invest $150,000 himself and either borrow the additional $200,000 or find a partner who will buy stock in the company. If Dalton borrows the money, the interest rate will be 6 percent. If, on the other hand, another equity investor is found, he expects to have to give up 60 percent of the company's stock. Dalton has forecasted earnings of about 16 percent in operating income on the firm's total assets.

Correct Answer:

Verified

Q77: The federal government provides funds to small

Q78: If Bill Bailey, owner of Cherokee Communications,

Q79: Business angels provide

A) asset-based loans.

B) factoring.

C) informal

Q83: You Make the Call-Situation 3

Steve Peplin is

Q84: List two methods of selling common stock,

Q85: You Make the Call-Situation 1

David Bernstein needs

Q86: What are the "five C's of credit"?

Q94: Guaranty loans are

A) made by private lenders.

B)

Q109: Private placement

A) is the sale of capital

Q113: Describe four different loan covenants that a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents