You Make the Call-Situation 2

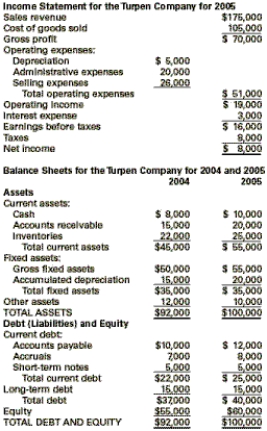

At the beginning of 2005, Mary Abrahams purchased a small business, the Turpen Company, whose income statement and balance sheets are shown below.

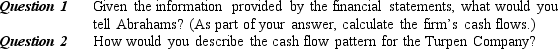

The firm has been profitable, but Abrahams has been disappointed by the lack of cash flows. She had hoped to have about $10,000 a year available for personal living expenses. However, there never seems to be much cash available for purposes other than business needs. Abrahams has asked you to examine the financial statements and explain why, although they show profits, she does not have any discretionary cash for personal needs. She observed, "I thought that I could take the profits and add depreciation to find out how much cash I was generating. However, that doesn't seem to be the case. What's happening?"

The firm has been profitable, but Abrahams has been disappointed by the lack of cash flows. She had hoped to have about $10,000 a year available for personal living expenses. However, there never seems to be much cash available for purposes other than business needs. Abrahams has asked you to examine the financial statements and explain why, although they show profits, she does not have any discretionary cash for personal needs. She observed, "I thought that I could take the profits and add depreciation to find out how much cash I was generating. However, that doesn't seem to be the case. What's happening?"

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: After their first day Ashley and Cameron's

Q57: In order to derive a cash flow

Q58: The major distinction between cash-basis and accrual-basis

Q59: Current assets include all of the following

Q60: Interest expense is deducted from the _

Q62: Describe the main reasons why profits based

Q63: The number resulting when taxes are subtracted

Q64: A company's net income depends on all

Q65: List the four primary ways an entrepreneur's

Q66: Name and define three categories of assets.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents