You Make the Call-Situation 2

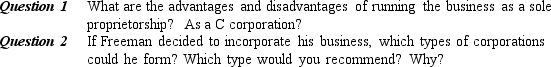

Matthew Freeman started a business in 1993 to provide corporate training in project management. He initially organized his business as a sole proprietorship. Until 1999, he did most of his work on a contract basis for Corporation Education Services (CES). Under the terms of his contract, Freeman was responsible for teaching 3- to 5-day courses to corporate clients-primarily Fortune 1000 companies. He was compensated according to a negotiated daily rate, and expenses incurred during a course (hotels, meals, transportation, etc.) were reimbursed by CES. Although some expenses were not reimbursed by CES (such as those for computers and office supplies), Freeman's expenses usually amounted to less than 1 percent of his revenues.

In 1999, Freeman increasingly found himself working directly with corporate clients rather than contracting with CES. Over the years, he had considered incorporating but had assumed the costs and inconveniences of this option would outweigh the benefits. However, some of his new clients said that they would prefer to contract with a corporation rather than with an individual. And Freeman sometimes wondered about potential liability problems. On the one hand, he didn't have the same liability issues as some other businesses-he worked out of his home, clients never visited his home office, all courses were conducted in hotels or corporate facilities, and his business involved only services. But he wasn't sure what would happen if a client were dissatisfied with the content and outcomes of his instruction. Finally, he wondered whether there would be tax advantages to incorporating.

Correct Answer:

Verified

Q62: One benefit of an S Corporation is

Q87: A corporation's board of directors

A) is the

Q101: What are the qualifications of partners?

Q101: You Make the Call-Situation 1

Ted Green and

Q103: You Make the Call-Situation 3

For years, a

Q104: What is the principal advantage of an

Q105: Explain the importance of social capital to

Q106: Discuss an Advisory Council as an alternative

Q107: Identify the six forms of legal organization

Q109: Identify some of the advantages and disadvantages

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents