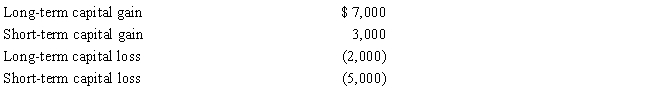

For the current year, Susan had salary income of $20,000. In addition she reported the following capital transactions during the year: There were no other items includable in her gross income. What is the amount of her adjusted gross income for the current year?

A) $19,000

B) $23,000

C) $24,000

D) $25,000

E) None of the above

Correct Answer:

Verified

Q21: An asset's adjusted basis is computed as:

A)Original

Q28: Nick received a gift of stock from

Q35: Which of the following is true about

Q36: Carlos bought a building for $113,000 in

Q37: Sol purchased land as an investment on

Q49: Ben purchased an apartment building about 10

Q59: For the current tax year, Morgan had

Q64: After 4 years of life in the

Q65: Which of the following assets is not

Q73: Which one of the following is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents