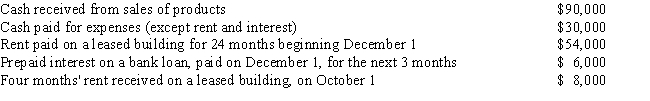

Polly is a cash basis taxpayer with the following transactions during the year:

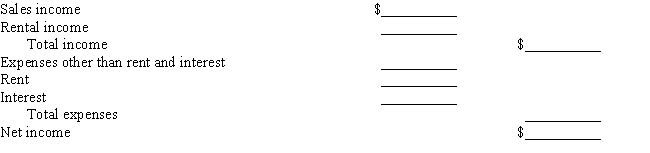

Calculate Polly's income from her business for this calendar year.

Correct Answer:

Verified

Q5: To be depreciated, must an asset actually

Q7: Depreciation refers to the physical deterioration or

Q8: Depreciation is the process of allocating the

Q10: Expenditures incurred to maintain an asset in

Q11: Automobiles generally have a 3-year cost recovery

Q12: Residential real estate is currently assigned a

Q16: If an asset's actual useful life is

Q35: In applying the statutory rates from the

Q38: ABC Corp bought a production machine on

Q39: Jenny constructed a building for use as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents