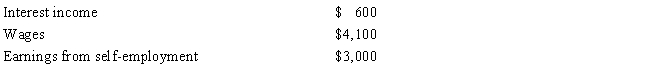

For the 2015 tax year, Sally, who is single, reported the following items of income: She maintains a household for herself and her 1-year-old son who qualifies as her dependent. What is the earned income credit available to her for 2015, using the tables?

A) $503

B) $1,369

C) $2,423

D) $2,627

E) None of the above

Correct Answer:

Verified

Q2: The use of the earned income credit

Q9: The child tax credit is $1,000 per

Q11: Calculate the child tax credits for the

Q13: Which one of the following taxpayers qualify

Q15: For 2015, Beatrice qualifies for the earned

Q16: Curly and Rita are married, file a

Q18: Bob and Carol file their tax returns

Q18: Which of the following tax credits is

Q19: For 2015, Wilson and Virginia Todd qualify

Q20: The child tax credit is not available

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents