John and Susan file a joint income tax return for 2015. They have two dependent children, students, ages 19 and 20. John earns wages of $108,000 and they have interest income of $2,000. In 2015, they settle a state tax audit and pay $50,000 for back state taxes due to an overly aggressive tax-sheltered investment.

Their other expenses for the year include:

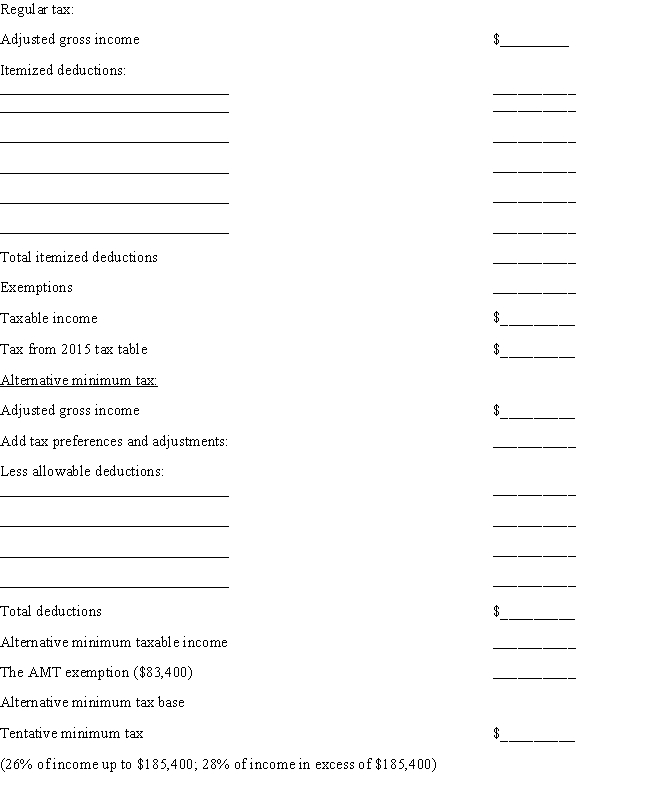

a.Calculate John and Susan's 2015 regular tax and tentative minimum tax on the schedule provided.

b.How much is the total tax liability shown on John and Susan's 2015 Form 1040?

Correct Answer:

Verified

Q38: Which of the following types of income

Q82: Which of the common deductions below are

Q86: Betty and Steve have a 4-year-old child,

Q87: In 2015, which of the following children

Q88: William and Irma have two children, Tom,

Q89: Although the alternative minimum tax (AMT)is meant

Q93: Assume Alan's parents make gifts of $10,000

Q95: Assume Karen is 12 years old and

Q97: If the net unearned income of a

Q100: Salary earned by minors may be taxed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents