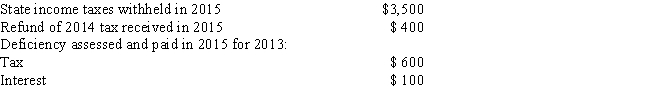

Frank is a resident of a state that imposes a tax on income. The following information pertaining to Frank's state income taxes is available: What amount should Frank use as state and local income taxes in calculating itemized deductions for his 2015 Federal tax return, assuming he elects to deduct state and local income taxes?

A) $3,500

B) $3,700

C) $4,100

D) $4,200

E) None of the above

Correct Answer:

Verified

Q29: Taxpayers are permitted to take an itemized

Q34: Harvey itemized deductions on his 2014 income

Q35: Sherry had $5,600 withheld from her wages

Q37: During the current year, George, a salaried

Q39: Newt is a single taxpayer living in

Q40: Weber resides in a state that imposes

Q60: During the current year,Cary and Bill incurred

Q66: Which of the following is not deductible

Q95: To deduct interest paid with respect to

Q99: Which of the following types of interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents