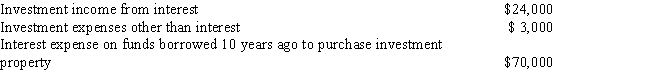

For the current tax year, David, a married taxpayer filing a joint return, reported the following: What is the maximum amount that David can deduct in the current year as investment interest expense?

A) $7,000

B) $20,000

C) $21,000

D) $24,000

E) None of the above

Correct Answer:

Verified

Q48: Bill has a mortgage loan on his

Q51: Amy paid the following interest expense during

Q54: Jerry and Ann paid the following amounts

Q55: Which of the following interest expense amounts

Q56: Fran paid the following amounts of interest

Q57: Shellie, a single individual, received her Bachelor's

Q72: Foreign income taxes paid are deductible.

Q85: Mortgage interest on a taxpayer's personal residence

Q91: Charu is charged $70 by the state

Q92: What is the maximum amount of home

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents