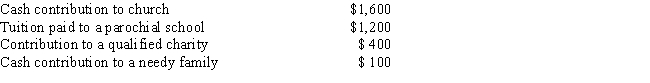

For 2015, Eugene and Linda had adjusted gross income of $30,000. Additional information for 2015 is as follows: What is the maximum amount that they can use as a deduction for charitable contributions for 2015?

A) $500

B) $1,600

C) $1,700

D) $2,000

E) None of the above

Correct Answer:

Verified

Q63: For a taxpayer with adjusted gross income

Q64: Dongkuk uses his holiday bonus to pay

Q67: Richie Rominey purchases a new $4.3 million

Q67: Gwen has written acknowledgments for each of

Q69: Douglas and Dena paid the following amounts

Q79: During the current year, Hom donates a

Q103: Alice purchases a new personal auto and

Q103: Which of the following charitable contributions is

Q112: Perry Mayson, a single taxpayer, graduated law

Q113: A taxpayer may donate the free use

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents