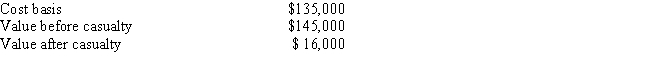

Harris had adjusted gross income in the current year of $126,000. During the year his personal summer home was almost completely destroyed by a cyclone. Pertinent data with respect to the home follows: Harris was partially insured for his loss and in the current year he received a $113,000 insurance settlement. What is Harris' allowable casualty loss deduction for the current year?

A) $0

B) $3,300

C) $3,400

D) $15,900

E) None of the above

Correct Answer:

Verified

Q82: If personal property is completely destroyed,the casualty

Q82: Don gives his old car to a

Q90: Which one of the following is not

Q91: Casualty and theft losses must be reduced

Q97: Sam operates a manufacturing company as a

Q101: If the taxpayer fails to locate a

Q102: Which of the following is a miscellaneous

Q114: An employee may deduct the cost of

Q116: If an employee receives a reimbursement for

Q117: Which of the following miscellaneous deductions is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents