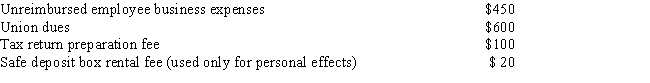

Peter is a plumber employed by a major contracting firm. During the current year, he paid the following miscellaneous expenses: If Peter were to itemize his deductions for the current year, what amount could he claim as miscellaneous itemized deductions (before applying the 2 percent of adjusted gross income limitation) ?

A) $100

B) $550

C) $1,070

D) $1,150

E) None of the above

Correct Answer:

Verified

Q103: If a ballet dancer seeks work as

Q104: Expenses of education to improve or maintain

Q109: Unreimbursed employee business expenses are miscellaneous itemized

Q113: Jean's employer has an accountable plan for

Q118: Carla is a high school teacher who

Q122: For married taxpayers filing a joint return

Q125: Melissa took a $1,500 distribution from her

Q130: Rachel's employer does not have an accountable

Q132: Geoffrey receives $20,000 from a qualified tuition

Q132: Tom is employed by a large consulting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents