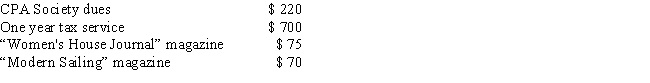

Catherine is a CPA employed by a large accounting firm in San Francisco. In the current year, she paid the following amounts: How much may she deduct on Schedule A as a miscellaneous deduction, before considering the 2 percent of adjusted gross income limitation?

A) $220

B) $920

C) $990

D) $1,065

E) None of the above

Correct Answer:

Verified

Q122: For married taxpayers filing a joint return

Q125: Melissa took a $1,500 distribution from her

Q127: Charles, a corporate executive, incurred business related,

Q130: Rachel's employer does not have an accountable

Q132: Tom is employed by a large consulting

Q132: Geoffrey receives $20,000 from a qualified tuition

Q133: Mary Lou took an $8,000 distribution from

Q136: Phillip,a single parent,would like to contribute $1,800

Q136: Which of the following is true with

Q139: April and Wilson are married and file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents