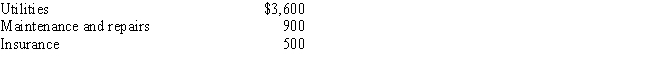

Bill is the owner of a house with two identical apartments. He resides in one apartment and rents the other apartment to a tenant. The tenant made timely monthly rental payments of $550 per month for the months of January through December 2015. The following expenses were incurred on the entire building: In addition, depreciation allocable to the rented apartment is $1,500. What amount should Bill report as net rental income for 2015?

A) $0

B) $100

C) $1,400

D) $2,600

E) None of the above

Correct Answer:

Verified

Q5: Donald owns a two-family home. He rents

Q8: Carmen owns a house that she rents

Q10: Donald rents out his vacation home for

Q11: Mike owns a house that he rents

Q61: If a residence is rented for 15

Q65: In most cases, an individual taxpayer reports

Q66: Walt and Jackie rent out their residence

Q73: The expenses associated with the rental of

Q75: Passive losses are fully deductible as long

Q78: Under the passive loss rules, real estate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents