Moe has a law practice and earns $322,000 which he reports on his Schedule C. His wife, Mindy, works part-time at Wal-Mart and earns $8,300. Mindy does not receive any medical benefits through Wal-Mart. Their 29-year-old daughter, Michelle, who is not a dependent, is working towards earning her Master's degree.

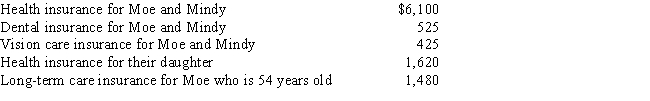

Moe and Mindy pay the following amounts:

How much may Moe and Mindy claim on their tax return as a self-employed health insurance deduction?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Arnold purchased two rental properties 6 years

Q25: Carey, a single taxpayer, purchased a rental

Q27: Christian, a single taxpayer, acquired a rental

Q31: Arnold purchased interests in two limited partnerships

Q36: Choose the correct statement.Passive losses

A)May not be

Q68: Dividend income is considered "passive income."

Q81: Norm is a real estate professional with

Q84: Ned has active modified adjusted gross income

Q91: Nancy has active modified adjusted gross income

Q99: Wages are considered "active income."

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents