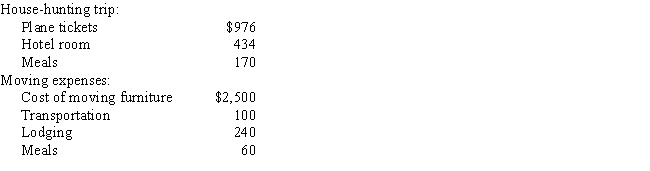

Gary and Charlotte incurred the following expenses in connection with Gary's job transfer from Florida to South Carolina:

How much is their qualified moving expense?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Earnings on nondeductible IRA contributions are allowed

Q17: Since a contribution to an IRA is

Q20: In some cases, a taxpayer may deduct

Q44: Unreimbursed qualifying moving expenses are an itemized

Q46: To qualify for the moving expense deduction,an

Q47: Which of the following is not a

Q49: A 42-year-old single taxpayer earning a salary

Q52: XYZ Corporation has assigned Allison to inspect

Q59: Which of the following statements is false

Q60: Monica has a Roth IRA to which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents