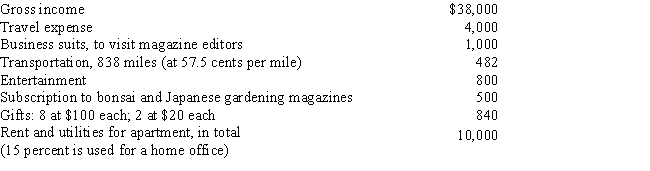

Lew started a business writing a popular syndicated Japanese gardening column in the current year and will report a profit for his first year. His results of operations are as follows:

What is the net income Lew should show on his Schedule C? Show the calculation of his taxable income.

Correct Answer:

Verified

Q1: Once a taxpayer uses the standard mileage

Q4: Maria runs a small business out of

Q11: What is the purpose of Schedule C?

Q12: When a taxpayer uses the FIFO inventory

Q15: Acacia Company had inventory of $300,000 on

Q19: Peter is a self-employed attorney. He gives

Q22: Paul is a self-employed investment adviser who

Q24: If the taxpayer does not maintain adequate

Q25: The cost of transportation from New York

Q27: Deductible transportation expenses:

A)Include meals and lodging.

B)Include only

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents