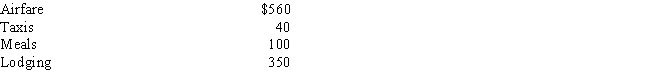

Barry is a self-employed attorney who travels to New York on a business trip during 2015. Barry's expenses were as follows: How much may Barry deduct as travel expenses for the trip?

A) $0

B) $950

C) $1,000

D) $1,050

E) None of the above

Correct Answer:

Verified

Q21: Vinnie has a small retail store and

Q23: If an employee is transferred to a

Q24: If the taxpayer does not maintain adequate

Q25: The cost of transportation from New York

Q30: Which of the following taxpayers may not

Q30: Christine is a self-employed tax accountant who

Q31: Rick is a business adviser who lives

Q33: The IRS has approved only two per

Q34: The standard mileage rate for automobiles in

Q35: If a taxpayer works at two or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents