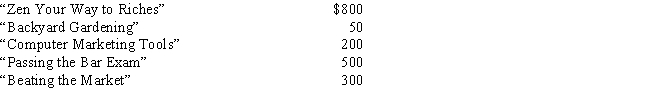

Michael has a very successful business as a financial consultant. Michael attends the following seminars:

How much can Michael deduct as business education expenses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Choose the correct answer.

A)Education expenses are deductible

Q54: The expense of travel as a form

Q62: To be deductible as the cost of

Q66: In which of the following situations may

Q70: The cost of a subscription to the

Q70: Carol, a CPA, is always required by

Q74: Sally is a high school math teacher.

Q75: Paul is a general contractor. How much

Q77: There is a limitation of $25 per

Q78: Natasha is a self-employed private language tutor.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents