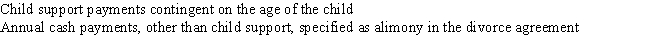

Laura and Leon were granted a divorce in 2006. In accordance with the decree, Leon made the following payments to Laura in 2015: How much should Laura include in her 2015 taxable income as alimony?

A) $0

B) $4,000

C) $6,000

D) $10,000

E) None of the above

Correct Answer:

Verified

Q48: Peter is required by his divorce agreement

Q56: Dr. J's outstanding player award is not

Q58: If an annuitant, whose annuity starting date

Q62: Payments made to a qualified retirement plan

Q65: In June of the current year, Rob's

Q68: Helga receives a $300,000 life insurance payment

Q77: Ordinarily life insurance proceeds are excluded from

Q79: Toby transfers to Jim a life insurance

Q80: If a life insurance policy is transferred

Q95: Geoff is a company president who has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents