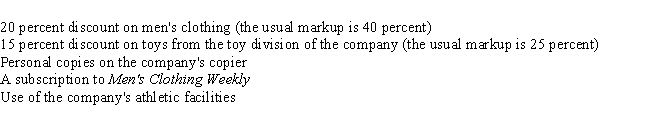

William, a single taxpayer, works for the men's clothing division of a large corporation. During the year, William received the following fringe benefits:

As a result of receiving the above fringe benefits, what amount must William include in his current year gross income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Marco and his family are covered by

Q101: The amount of employee reimbursement in 2015

Q106: For 2015, the maximum percentage of Social

Q109: Unemployment compensation is fully taxable to the

Q114: Which of the following is correct?

A)Employee discounts

Q117: Susie received unemployment benefits in the current

Q121: In some cases, Social Security benefits may

Q126: In regards to Social Security benefits:

A)The Social

Q131: During the current year, Margaret and John

Q140: During the tax year, Thomas and Yolanda

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents