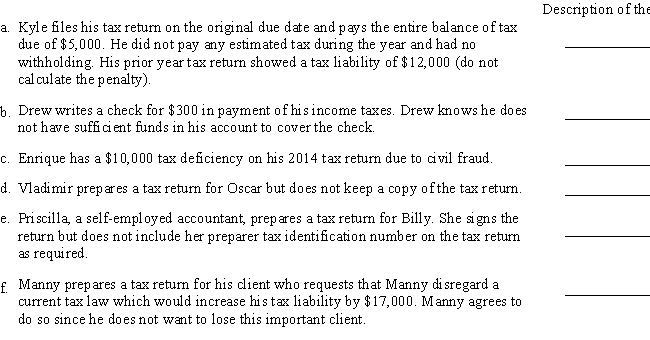

For each of the following situations, indicate the nature and amount of the penalty that could be imposed. (The penalties include both tax practitioner penalties and taxpayer penalties).

Correct Answer:

Verified

Q5: Which of the following is not a

Q10: The Wage and Investment Office of the

Q11: Taxpayers are required by law to maintain

Q21: The tax law contains a penalty for

Q22: The IRS determined that John underpaid his

Q26: Which of the following will not affect

Q26: If a calendar year taxpayer's 2015 individual

Q27: What type of audit (office, field or

Q30: Answer the following:

a.Geoffrey filed his tax return

Q35: The statute of limitations for a tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents