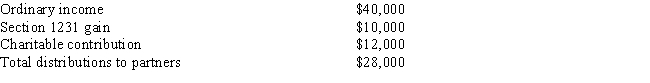

Jennifer has a 25 percent interest in the Aspen Aircraft partnership. Her basis in her partnership interest is $10,000 at the beginning of 2015. The partnership reported the following activity for 2015:

What is Jennifer's basis in her partnership interest at the end of 2015?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: J. Bean and D. Counter formed a

Q24: Please answer the following questions:

a.What form is

Q25: A partnership must separately report Section 1231

Q25: Cooke and Thatcher form the C&T Partnership.Cooke

Q27: Nash and Ford are partners who share

Q28: Partnership income is taxed at the same

Q31: The partnership of Truman and Hanover realized

Q33: A partner contributes assets with a basis

Q36: Partnership losses that are not used because

Q38: Which one of the following is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents