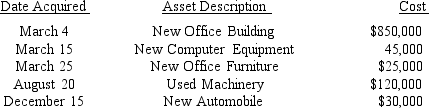

YumYum Corporation (a calendar-year corporation) moved into a new office building adjacent to its manufacturing plant in 2015.It purchased and placed in service the following assets during 2015:  All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum does not use Section 179 expensing and it elects to use straight-line depreciation on all of its assets,how much is its 2015 depreciation deduction?

All assets are used 100% for business use.The office building does not include the cost of the land on which it is located that was an additional $300,000.The corporation had $900,000 income from operations before calculating depreciation deductions.If YumYum does not use Section 179 expensing and it elects to use straight-line depreciation on all of its assets,how much is its 2015 depreciation deduction?

A) $17,281

B) $28,972

C) $35,134

D) $35,394

Correct Answer:

Verified

Q21: Joe started a new business this year.He

Q29: The adjusted basis of an asset is:

A)Its

Q33: The after-tax cost of an asset increases

Q34: Gribble Corporation acquires the Dibble Corporation for

Q38: Peter received his uncle's coin collection as

Q40: Jack did not depreciate one of his

Q43: Momee Corporation,a calendar-year corporation,bought only one asset

Q44: During the year,Garbin Corporation (a calendar-year corporation

Q47: Useful lives for realty include all of

Q48: YumYum Corporation (a calendar-year corporation)moved into a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents