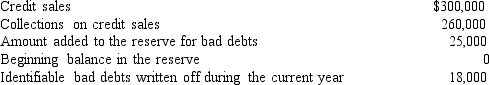

Fabricio,Inc.is an accrual-basis corporation.It ages its receivables to calculate the addition to its reserve for bad debts.The following were reported during the current year:  The amount deductible for bad debt expense on Fabricio's tax return for the current year is:

The amount deductible for bad debt expense on Fabricio's tax return for the current year is:

A) $18,000

B) $25,000

C) $40,000

D) $43,000

Correct Answer:

Verified

Q25: To deduct a bad debt expense for

Q29: All of the following expenses are deductible

Q41: Andrew's hobby is painting.During the current year,Andrew

Q46: Gina flew from Miami to San Diego

Q55: Corinne's primary business is writing music.She uses

Q57: Perez Corporation paid the following expenses: $14,000

Q57: Which of the following would not be

Q59: Allison Corporation (marginal tax rate of 34%)has

Q60: Robert's adjusted gross income is $70,000 and

Q66: In 2014,Jasmin loaned her friend Janelle $5,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents