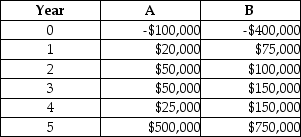

Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative.Project A and B have the cash flows as shown and Inatech uses a required rate of return of 10% and an inflation rate of 4%.Compute the payback in years and the net present value for both projects and offer advice as to the best course of action.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Describe the use of a profile model

Q58: Your university is considering two projects to

Q62: What is the time value of money

Q74: What are options models and when should

Q75: What two simple rules should be followed

Q77: How can a payback period approach be

Q97: Choose any example from recent news media

Q100: Successful firms use project portfolio planning routinely

Q101: Rank the problems in implementing portfolio management

Q101: Inatech is contemplating two different projects and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents