Silver Prices

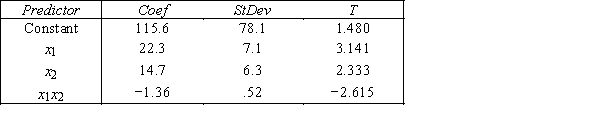

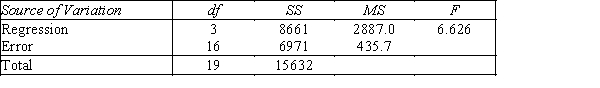

An economist is in the process of developing a model to predict the price of silver.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the first-order model with interaction: y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below. THE REGRESSION EQUATION IS y = 115.6 + 22.3x1 + 14.7x2− 1.36x1x2  S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

S = 20.9 R−Sq = 55.4% ANALYSIS OF VARIANCE

-{Silver Prices Narrative} Is there sufficient evidence at the 1% significance level to conclude that the price of a barrel of oil and the price of silver are linearly related?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: A first-order model was used in regression

Q64: Motorcycle Fatalities

A traffic consultant has analyzed

Q65: Silver Prices

An economist is in the

Q66: Motorcycle Fatalities

A traffic consultant has analyzed

Q67: Motorcycle Fatalities

A traffic consultant has analyzed

Q69: Silver Prices

An economist is in the

Q70: Silver Prices

An economist is in the

Q71: It is not possible to incorporate nominal

Q72: Motorcycle Fatalities

A traffic consultant has analyzed

Q73: In explaining the amount of money spent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents